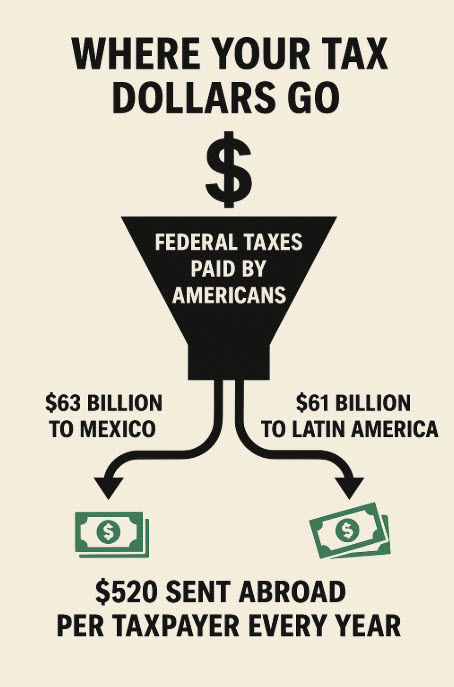

When Americans debate illegal immigration, the conversation typically revolves around border security, crime, or the strain on schools and hospitals. But one of the most overlooked aspects is the massive financial outflow leaving the United States in the form of remittances—money sent by immigrants to family members in their home countries. Mexico alone receives over $63 billion annually, while Central and South American countries receive another $61 billion, bringing the total to at least $124 billion. These remittances are enabled, in part, by a combination of open-border policies and U.S. taxpayer-funded welfare programs—many concentrated in progressive-run states like California.

Yet this isn’t just a “California problem.” Ordinary taxpayers across America, even those in conservative states, are subsidizing this system. Through federal taxation and funding formulas, wealth from the heartland is funneled into sanctuary policies and welfare benefits that free up cash for remittances. What appears as “state generosity” on the surface is often federally underwritten dependency, resulting in an economic model that benefits foreign nations and globalist ideologues, not American citizens.

$124 billion in remittances to Mexico and other Central and South American countries amounts to $520 per year, per taxpayer. California is very generous with our money.

The Remittance Economy: An International Lifeline Funded Domestically

Remittances are defined as money transfers from individuals working in a foreign country to recipients—usually family members—in their country of origin. These flows can include:

- Personal transfers via Western Union, bank wires, or mobile apps;

- Compensation of employees working abroad;

- Household-to-household capital transfers, such as savings or investments.

Remittance data is tracked by central banks in recipient nations (e.g., Banco de México), which collect information from financial institutions and wire services. These figures are compiled and published by international bodies such as the World Bank and International Monetary Fund.

For 2023:

- Mexico reported $63 billion.

- Central and South America collectively received $61 billion.

This $124 billion estimate is already staggering, but it doesn’t tell the whole story.

The True Size of the Remittance Pipeline Is Likely Much Larger

Several factors suggest the actual amount of U.S. wealth flowing into Latin America via remittances is far higher than official numbers indicate:

- Informal Transfers Are Not Tracked

- Cash carried across the border by individuals;

- “Mules” or remittance couriers operating in border towns;

- Personal trips where physical goods or prepaid debit cards are brought home.

- Peer-to-Peer and Crypto Transfers

- Money sent via unregulated digital apps or cryptocurrency can escape detection.

- Welfare-Funded Transfers

- The origin of the funds is not reported. In many cases, welfare programs cover basic needs (rent, food, healthcare), allowing earnings to be diverted abroad.

- False or Inflated Claims

- Some remittances may be boosted by tax fraud, such as claiming child tax credits for dependents who do not reside in the U.S.

The true remittance total may well exceed $150 billion, with the shortfall in tracking due to weak oversight and political unwillingness to audit the system.

How These Funds Are Freed Up

Many individuals sending remittances are low-income earners. So how can they afford to send hundreds or even thousands of dollars abroad each month?

The answer lies in the U.S. public benefits system, which indirectly subsidizes remittances. Programs such as:

- SNAP (Food Stamps)

- Section 8 Housing Vouchers

- Medicaid/Medi-Cal

- WIC

- School lunch and breakfast programs

- Earned Income Tax Credit (EITC)

- Child Tax Credit

These programs provide a safety net that frees up disposable income. In a typical low-income or illegal-immigrant household in California or New York, expenses like food, rent, and medical care are heavily subsidized or entirely covered—leaving more money to send home.

California’s state-level generosity (e.g., free healthcare for all income-eligible residents regardless of immigration status) is well known. However, the majority of these programs are federally funded or federally matched.

The Key Question: How Do Ordinary Taxpayers in Red States End Up Paying?

Here’s the core issue: many conservative Americans mistakenly believe this problem is isolated to leftist-run coastal states. In reality, federal tax policy and spending structures mean that residents of Indiana, Texas, Florida, and elsewhere are subsidizing California’s open-border welfare economy.

Let’s examine how this works:

1. Federal Taxes Collected Nationwide

Federal programs like Medicaid and SNAP are funded through federal income and payroll taxes collected from citizens in all 50 states. That means someone in Ohio or Alabama is funding the welfare benefits being used in Los Angeles or El Paso.

2. Federal-to-State Reimbursement Formulas

Even when a state like California expands services to illegal immigrants through Medi-Cal or other programs, they often do so with partial or full federal matching funds. For example:

- For every dollar California spends on Medicaid, the federal government matches at a rate between 50% and 90%, depending on the specific program.

- Emergency Medicaid and public health funds distributed during COVID went disproportionately to border states—but came from federal budgets.

3. COVID and Emergency Aid Abuse

Federal pandemic aid to sanctuary cities, border shelters, and refugee programs diverted FEMA and HHS funds from their original purpose. These dollars came from Washington—but were originally extracted from taxpayers in states with balanced budgets and better governance.

4. Earned Income Tax Credit and Child Tax Credit

Even illegal immigrants—through use of Individual Taxpayer Identification Numbers (ITINs)—can claim tax credits for children, including those who do not live in the U.S. These refunds can be thousands of dollars per family per year. Again, this money comes from the general federal tax pool.

The Result: A Federal Engine Powering Global Remittance

The structure looks like this:

Federal Taxpayer → IRS/HHS/DHS/FEMA → California Welfare Programs and NGO Networks → Cash Freed for Remittances → Foreign Economies (Mexico, Guatemala, etc.)

By combining open-border non-enforcement with taxpayer-funded welfare and legal loopholes, the federal government has built a transnational redistribution machine. The beneficiaries are:

- Foreign governments

- Multinational financial firms handling wire transfers

- Left-wing political machines in sanctuary states

The losers? Every American citizen who pays their taxes, plays by the rules, and watches as hospitals fill, classrooms overflow, wages fall, and national cohesion disintegrates.

Incentivizing Dependency Abroad

The incentives are perverse. Instead of requiring Latin American governments to reform, secure their own borders, or offer economic opportunity, U.S. policy allows them to export their poverty problem to us. Worse still, we fund it.

In fact, these governments have become openly dependent on remittances:

- Mexico’s president calls them “a blessing.”

- Guatemala’s economic ministry has issued guides for migrating to the U.S. to maximize remittance transfers.

- NGOs in Honduras run training seminars on claiming asylum at the U.S. border—even for those who clearly don’t qualify under U.S. law.

Rather than being grateful or collaborative, these nations often criticize the U.S., support leftist revolutionary movements, or—as in the case of Mexico—refuse to take back their own criminal deportees.

National Security and Cultural Implications

A nation cannot survive if it subsidizes the weakening of its own sovereignty. The remittance-fueled immigration system:

- Rewards lawbreaking over lawful entry.

- Displaces low-income American workers.

- Erases distinctions between citizen and non-citizen.

- Transfers wealth from the governed to foreign nationals.

- Weakens national identity and cohesion.

It’s also an immigration policy without consent. Congress has not authorized this arrangement; the American people have not voted for it. Yet it persists—empowered by executive orders, activist judges, and unelected bureaucrats.

What Needs to Be Done

- Enforce immigration law at the border and in the interior.

- Close asylum loopholes.

- End catch-and-release.

- Require proper identification and work eligibility.

- Reform welfare eligibility.

- No public benefits for illegal aliens.

- Audit mixed-status households for benefit fraud.

- Block the use of ITINs for refundable tax credits.

- Tax or restrict remittances.

- Implement a small federal fee or tax on remittances sent from the U.S. to certain countries.

- Require proof of legal residence before wire transfers over $1,000.

- Cut off federal funding to sanctuary cities.

- Any state or city that shields illegal immigrants should lose access to federal housing, healthcare, and transportation grants.

- Educate the public.

- The average voter in Iowa or Kentucky must understand that they are paying for California’s open-border chaos.

The Hidden Taxation of Sovereignty

The flood of remittances leaving the United States—now exceeding $124 billion annually to Latin America—is not just the fruit of hard work. It is the consequence of a deliberately broken system. It is powered by public policy, subsidized by the American taxpayer, and protected by political elites.

Mexico, Guatemala, and others are not freeloading by accident. They’re doing what their leaders believe is in their national interest. The shame is on America’s leaders, who have failed to put our national interest first.

The ordinary taxpayer—whether in Kansas or Florida—must understand this: You are paying for a system that takes your money, funds illegal residency, and transfers your nation’s wealth abroad. It’s time to wake up, speak out, and demand change.

S.D.G.,

Robert Sparkman

rob@christiannewsjunkie.com

RELATED CONTENT

Concerning the Related Content section, I encourage everyone to evaluate the content carefully.

Some sources of information may reflect a libertarian and/or atheistic perspective. I may not agree with all of their opinions, but they offer some worthwhile comments on the topic under discussion.

Additionally, language used in the videos may be coarse. Coarse language does not reflect my personal standards.

Also, I do not acknowledge that anyone transitions from male to female, and vice versa. While I might use the language of the left, I do not believe their concepts. Trans men are women deluded into thinking they are men, and trans women are men deluded into thinking they are women. Trans men are not men, and trans women are not women.

Finally, those on the left often criticize my sources of information, which are primarily conservative and/or Christian. Truth is truth, regardless of how we feel about it. Leftists are largely led by their emotion rather than facts. It is no small wonder that they would criticize the sources that I provide. And, ultimately, my wordview is governed by Scripture. Many of my critics are not biblical Christians.

Feel free to offer your comments below. Respectful comments without expletives and personal attacks will be posted and I will respond to them.

Comments are closed after sixty days due to spamming issues from internet bots. You can always send me an email at rob@christiannewsjunkie.com if you want to comment on something, though.

I will continue to add items to the Related Content section as opportunities present themselves.